Compulsive Shopping And Spending An Indicator Of Shopping Dependency?

Modern-day Money Theory: A Primer On Macroeconomics For Sovereign Financial Systems Springerlink

Caregivers are entrusted with not just fulfilling their daily jobs, but also the needs positioned on them as they provide support for their liked one. It is critically vital that as caretakers we comprehend the effect of this duty on our daily life and how it can potentially impact our wellness. Through this webinar we will function to determine potential obstacles to stabilize and look at possibilities for limits all while taking care of another.

Retirement

- So, it must come as no surprise that lots of people are struggling with financial debt.

- A full-picture plan starts with considering several non-financial facets of retirement.

- The minimal get demands imposed by the central bank do not make a difference, other than, perhaps, for the (fairly modest) quantity of interest-borne seigniorage which the reserve bank is able to provide to the treasury.

- The prospect alone will encourage the financial industry to push ahead with clearing out cash money-- which consequently would decrease the remaining minimal central-bank control over financial institutions even more.

- Come learn more about the elements of an effective estate plan and hear about methods to guarantee that your dreams are fulfilled.

If this holds true, it adheres to, in addition, that central banks do not especially affect financial growth and employment, not under fractional get banking, not in typical times, and not sustainably by emergency procedures in times of situation. The explanation for the reduced degree of interest rates which is most regular with the truths hence is the cost savings glut theory. ' Savings glut', though, appears rather safe again and could equally be called 'cash excess'. It resulted from the large transatlantic debt and financial obligation bubble which partly burst in real estate, yet was provisionally taken care of for the rest by the reserve banks and federal governments included, particularly, too, as regards MFI financial debt and sovereign debt. Left behind is an extra of money supply that has actually shed, due to the crisis, a matching need for money and much of the previous monetary investment opportunities.

Tax Filing Issues In Separation

They rely on self-regulation, consisting of self-limitation, of money and resources markets. They have actually constantly done so, from the banking-school genuine expenses teaching at the beginning of the 19th century approximately the contemporary monetary efficient-market hypothesis. In the real life, nonetheless, cash has ended up being pure fiat cash, a lot of it developed by bank fiat without anchorage in a real worth base.

Even if reserve banks desired the rising cost of living rate to be higher, it is once more doubtful whether they could do much concerning it. They would certainly have to continue to participate in QE transactions, while federal governments would certainly have to drop back to budget deficit on a large scale. This after that could really set off inflation, however without independent development. Because 2008 central banks have actually cut their lending passion to in between 1 and 0%, and therefore plainly listed below existing inflation prices. Instead of being the reason, they are the result of uncommonly low rate of interest generally. The central banks' role as fractional refinancers, subsidiary as it remains in regular times, gains massive importance in times of dilemma.

Discover for yourself why the breath is your body's portal to internal peace. Learn to listen to your body and the crucial messages it holds for you. Finally, build an arsenal of reliable breathing and muscle mass relaxation exercises that you will enjoy. Discover how to assist make your cash work harder by using your cash flow better, creating excellent conserving practices and far better handling financial debt.Prior to turning to the central bank, banks usually offer excess reserves among each other on the interbank market. If, however, banks think each other of being close to illiquidity and insolvency, they stop lending to each various other, and this is the minute when central banks need to rescue private financial institutions or the entire field. The following action towards near-complete self-reliance of financial institutions from reserve banks would certainly be eliminating cash (coins and notes). The financial institutions are sustained in this by technological innovation (digital money) and motivated by the tax obligation workplace that wants to eliminate paper cash under the table. The gold requirement still stood for the framework for financial reasoning, the credit theory of financial institution money from the 1890s was not typically understood, and the share of central-bank cash in contrast with bank cash in M1 had to do with 66-- 50%. Today, the share of financial institution money has reached 80 to over 95%, relying on the financial aggregate concerned.

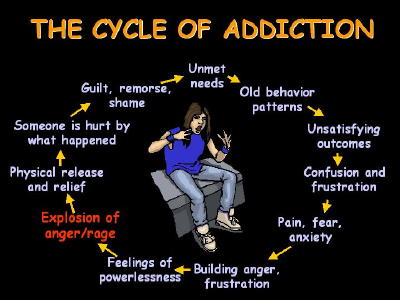

In order to end up being efficient, reserve banks must be enabled to be real masters of the cash system. They need to gain complete control of the money using financial amount plan. No quantity policy is feasible, nevertheless, as long as the banking market controls the financial system and determines the entire stock of cash, while cash and capital markets inherently fall short to reach some 'stability' and self-limitation. To conclude, financial institutions have to quit functioning as financial quasi-authorities and end up being totally banks, indicating that the financial sector should be removed of its financial power to produce and remove money-on-account by creating or removing key credit history. Financial institutions ought to be free lending and investment ventures, but simply cash middlemans in this without the invalid opportunity of conducting service on the basis of self-created cash. The quantities of money and books that the banks require to accomplish payments stand for only a fraction of the existing supplies of bank money, therefore the term fractional reserve financial.This privacy policy follows federal regulations and guidelines. When you find yourself using shopping as a coping mechanism for anxiety, boredom, or emotions, it could be time to ask on your own if it's becoming more than simply a safe practice. The thrill of endorphins when https://nyc3.digitaloceanspaces.com/mindfulness-coaching/Certified-Life-Coach/psychotherapy-counselling/5-indications-you-could-be-addicted-to-investing.html you find that ideal thing can be addictive, and before you recognize it, you're caught in a cycle of consistent purchasing. A financial obligation administration plan can provide you a much lower rates of interest on charge card debt and lower month-to-month payments.

Things is that older and younger middle-class people alike put more of their non reusable money in financial-market dealings. The not-so-harmless side of this includes enhanced monetary instability in addition to expanding inequality and division in the social distribution of wealth, job and income. Good analogy comparing economic connections with cheating! This is an underdiscussed sensation around financial adultery and its emotional origins.