Late Expenses and Organization Bank card Loans: How to stay away from Unneeded Expenses

Introduction: Being familiar with the Impact of Late Expenses and Business Charge card Loans

Late service fees and enterprise credit card loans may have a major impact on the economic health and fitness of your business. Small firms often trust in bank cards to finance their operations, include fees, and control income stream. However, failing to know the terms and conditions associated with these credit card financial loans may lead to pointless costs and monetary strain.

In this detailed guidebook, We're going to explore different components of late charges and organization credit card financial loans. We are going to explore strategies in order to avoid needless rates, have an understanding of different funding solutions readily available, and provide professional tips on running your organization bank card proficiently. Regardless if you are a startup entrepreneur or a longtime business proprietor, This information will equip you with the awareness and resources to navigate the world of small business credit cards devoid of incurring avoidable costs.

FAQs about Late Service fees and Organization Bank card Loans

What are the results of late payments on a business bank card?

Late payments may lead to hefty late charges, amplified interest costs, and damage to your credit rating rating. Also, recurring late payments might bring about lowered credit score restrictions as well as account closure.

Can I negotiate or waive late costs on my company credit card?

It is possible to barter or ask for a waiver for late expenses, particularly when you do have a fantastic payment heritage. Speak to your bank card issuer and clarify your condition; They could be prepared to accommodate your request.

What are some common factors for incurring late costs on business bank cards?

Common reasons for incurring late expenses contain forgetting payment due dates, inadequate resources inside the banking account connected to the credit card, or delays in processing payments.

How am i able to prevent late charges on my enterprise bank card?

To stop late service fees, arrange automated payments or reminders for payment thanks dates, maintain a sufficient equilibrium in the bank account, and promptly deal with any difficulties with payment processing.

Are there any grace intervals for business enterprise charge card payments?

Lots of enterprise bank cards give you a grace period of time, typically starting from 21 to 25 days, all through which you'll be able to pay out your balance in comprehensive with no incurring fascination charges. It is important to grasp the particular terms and conditions affiliated with your credit card.

What steps am i able to get to enhance my credit rating and prevent avoidable expenses?

To transform your credit history score and steer clear of needless prices, make timely payments, maintain your credit history utilization low, observe your credit history report consistently, and handle any inaccuracies or discrepancies promptly.

Late Service fees and Company Charge card Financial loans: Comprehending the Basics

Small Business Bank card Funding: A Viable Choice for Entrepreneurs

Small organization charge card funding provides entrepreneurs a practical way to entry capital speedily. With aggressive curiosity charges and versatile repayment alternatives, these bank cards deliver much-essential economical versatility for startups and tiny firms.

Unsecured Company Credit history Strains: A Danger-Absolutely free Financing Solution

Unsecured small business credit rating strains are a pretty option for companies that do not want to offer collateral. These lines of credit rating help you borrow cash without putting your belongings at risk though furnishing the pliability to attract around the money as needed.

Business Charge card Hard cash Developments: Fast Entry to Funds

Business bank card cash innovations help you withdraw funds from your credit card's readily available equilibrium. Although this can be a quick Option for brief-phrase liquidity wants, it can be crucial to grasp the connected expenses and interest charges.

Credit Card Loans for Startups: Fueling Expansion and Innovation

Startups often encounter troubles On the subject of securing common financial loans. Credit card financial loans provide startups an alternative funding selection with less constraints and more available approval procedures.

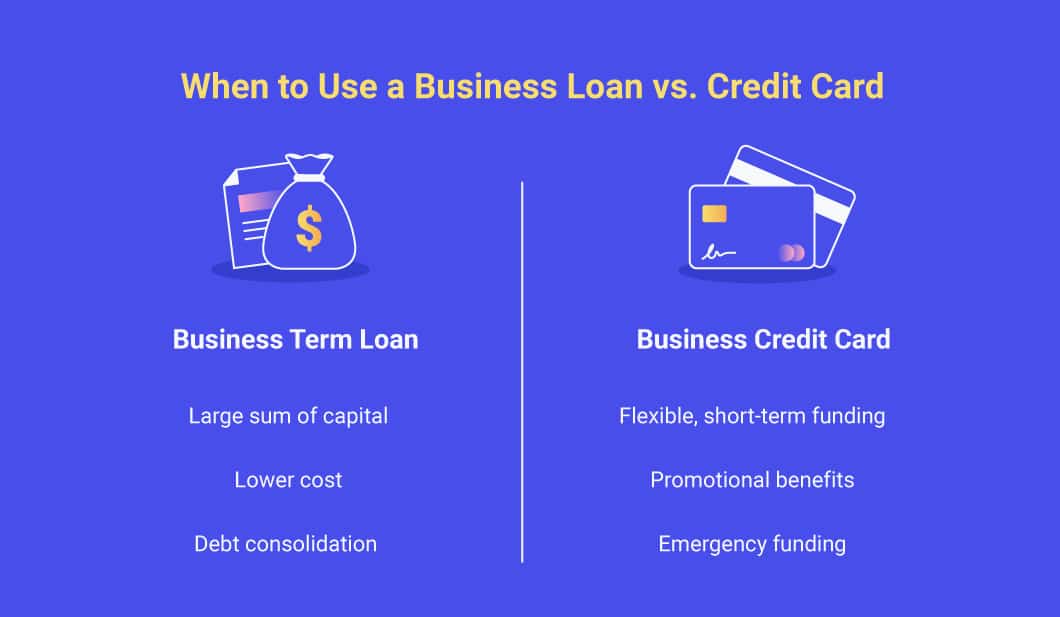

Business Credit Card Personal debt Consolidation: Streamlining Your Finances

If your enterprise has several charge card debts with large interest rates, consolidating them into an individual small business charge card can assist streamline your finances. This strategy helps you to deal with your personal debt much more proficiently and perhaps preserve on interest prices.

Short-Expression Organization Credit Card Funding: Conference Speedy Capital Needs

Short-time period enterprise credit card funding is a good solution for firms that have to have rapid usage of money. Regardless of whether it's covering unforeseen bills or Profiting from time-delicate prospects, these charge cards provide brief financing alternatives.

Business Charge card Rewards Applications: Maximizing Rewards in your Business

Business credit card rewards applications supply incentives and Advantages customized to the desires of companies. From hard cash back again on buys to vacation benefits, these packages may also help offset prices and boost your bottom line.

Credit Card Financial loans for Business owners: Empowering Company Owners

Entrepreneurs frequently encounter exclusive issues In relation to financing their ventures. Bank card loans provide entrepreneurs Together with the money overall flexibility they need to gasoline their company expansion and pursue their vision.

Business Bank card Curiosity Fees: Understanding the expense of Borrowing

Business charge card fascination fees Perform a vital position in determining the price of borrowing. It is crucial to check charges offered by distinctive issuers and know how curiosity prices can effect your In general debt.

Credit Card Loans for Little Corporations: Customized Financing Solutions

Small companies have varied funding needs, and credit card financial loans supply tailored options. From handling cash circulation to funding expansion assignments, these financial loans give tiny organizations with the necessary means to thrive.

Business Charge card Equilibrium Transfers: Consolidating Personal debt with Ease

If your business has accrued superior-interest credit card debt on numerous charge cards, a stability transfer may also help consolidate your balances on to a single card with reduce fascination prices. This method simplifies repayment and most likely reduces desire expenses.

Conclusion

Late charges and unneeded charges connected with company bank card financial loans can appreciably effect your organization's financial well being. By being familiar with the terms and conditions of one's charge card, starting payment reminders, and Discovering different funding solutions, you'll be able to keep away from needless rates and successfully deal with your online business bank card loans.

Remember to prioritize timely payments, manage a superb credit rating rating, and consistently evaluation your economic statements to make certain your organization's very You can find out more long-term achievement. With the appropriate understanding and proactive solution, it is possible to navigate the globe of organization credit cards with self esteem, staying away from needless rates and maximizing the benefits they supply.