Mastering Payroll Management with an Effective Paystub Generator

Introduction

In today's fast-paced business world, managing payroll can be a daunting task. With numerous regulations, tax requirements, and employee benefits to consider, it's essential to have a reliable and efficient system in place. One tool that has revolutionized payroll management is the effective paystub generator. In this Find more information article, we will explore how mastering payroll management with an effective paystub generator can streamline your processes, increase accuracy, and save you time and money.

Benefits of Using a Paystub Generator

1. Accurate Record Keeping for Tax Purposes

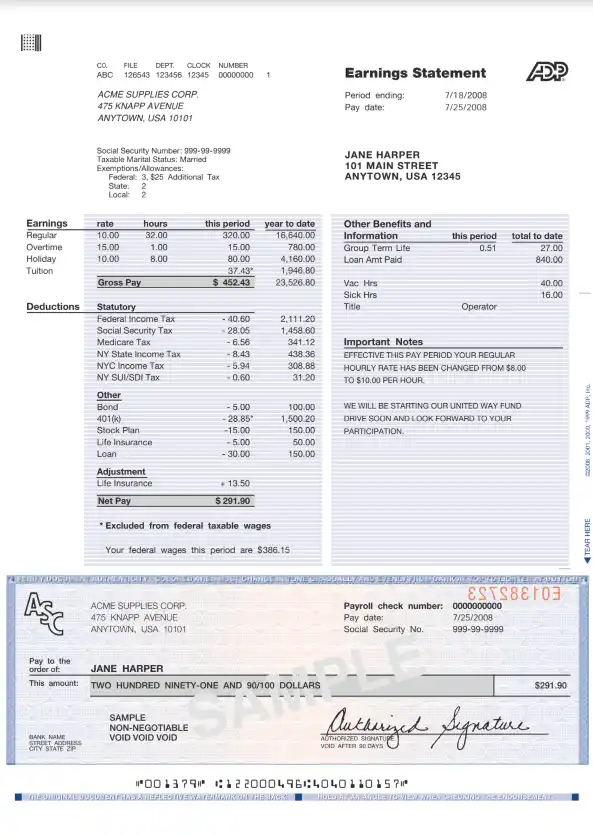

With ever-changing tax laws and regulations, keeping accurate records is crucial for businesses of all sizes. A paystub generator ensures that all necessary information is included on each paystub, such as employee wages, deductions, and taxes withheld. This not only simplifies the process of filing taxes but also reduces the risk of errors or omissions.

2. Streamlined Payroll Processes

Manually calculating and distributing paychecks can be time-consuming and prone to errors. By using an effective paystub generator, you can automate these processes, saving valuable time for both you and your employees. The system can calculate deductions, taxes, and net pay automatically based on pre-defined formulas or parameters set by your company.

3. Enhanced Employee Transparency

Employees appreciate transparency when it comes to their wages and benefits. A paystub generator provides detailed information about their earnings, including gross pay, deductions for taxes and benefits, and net read more pay. This helps build trust between employers and employees by ensuring openness in compensation practices.

4. Easy Access to Historical Data

A reliable paystub generator archives past paystubs electronically, allowing easy access to historical data when needed. Whether it's for auditing purposes or resolving employee inquiries about previous payments, having this information readily available saves time and effort.

How to Make Check Stubs with an Effective Paystub Generator

1. Choose a Reliable Paystub Generator Tool

When selecting a paystub generator tool, it's crucial to choose one that meets your specific business needs. Look for features such as customizable templates, automatic calculations, and the ability to generate paystubs in various formats (PDF, HTML, etc.). Consider factors like ease of use, customer support, and affordability.

2. Enter Employee Information

Once you've chosen a paystub generator tool, the next step is to enter employee information accurately. This includes the employee's name, address, Social Security number, hourly or salaried rate, and any additional information required for tax purposes.

3. Define Deductions and Benefits

To ensure accurate calculations of net pay, it's essential to define deductions and benefits within the paystub generator tool. This includes items such as federal and state taxes, Social Security and Medicare contributions, retirement plan deductions, and health insurance premiums.

4. Generate Paystubs

With all necessary information entered into the paystub generator tool, you can now generate paystubs for your employees. The system will automatically calculate gross pay, deductions, taxes withheld, and net pay based on the provided data. You can then download or print the paystubs for distribution.

5. Review and Distribute Paystubs

Before distributing paystubs to employees, it's essential to review them for accuracy. Double-check all calculations and ensure that all necessary information is included. Once verified, distribute the paystubs to employees either physically or electronically based on your company's policies.

How to Make Fake Pay Stubs: Avoiding Fraudulent Practices

While using a paystub generator offers numerous benefits for legitimate payroll management purposes, it's important to address the issue of fake or fraudulent pay stubs. Some individuals may attempt to create fake pay stubs to inflate their income or deceive lenders, landlords, or other entities.

Creating and using fake pay stubs is illegal and can result in severe consequences. It's essential to maintain integrity and honesty in all financial transactions. Engaging in fraudulent practices can lead to legal action, reputational damage, and loss of trust from both employees and external parties.

Frequently Asked Questions (FAQs)

1. How to make a paystub?

To make a paystub, you can utilize an effective paystub generator tool. Enter the necessary employee information, define deductions and benefits, and generate the paystub with accurate calculations. Review the paystub for accuracy before distributing it to employees.

2. Are fake pay stubs legal?

No, creating or using fake pay stubs is illegal. It's important to maintain honesty and integrity in all financial transactions to avoid legal repercussions and damage to your reputation.

3. Can I use a paystub generator for self-employed individuals?

Yes, a paystub generator can be used for self-employed individuals as well. It allows you to calculate your net income accurately and provide detailed records for tax purposes.

4. How can a paystub generator help with apartment applications?

When applying for an apartment, landlords often require proof of income. A paystub generator can help you create accurate pay stubs that demonstrate your income and financial stability, increasing your chances of being approved for the apartment.

5. How do I bypass SNAPPT verification?

Engaging in practices to bypass SNAPPT verification or any other legitimate verification process is unethical and potentially illegal. It's crucial to maintain honesty and integrity in all financial dealings.

6. Can a paystub generator help build business credit?

While a paystub generator provides accurate records of employee wages, it doesn't directly impact business credit. Building business credit involves establishing relationships with lenders, paying bills on time, and maintaining a positive financial track record.

Conclusion

Mastering payroll management with an effective paystub generator is an essential step towards streamlining your processes, ensuring accuracy, and promoting transparency in compensation practices. By utilizing a reliable paystub generator tool, you can automate payroll calculations, maintain accurate records for tax purposes, and enhance employee trust. However, it's crucial to use such tools responsibly and avoid engaging in fraudulent practices. Always prioritize honesty and integrity in all financial transactions to build a solid foundation for your business's success.